Examples of assets include cash, accounts receivable, inventory, property, plant, and equipment. If you’re looking to buy common stock and you’re completely new to investing, the first step is to open a brokerage account if you don’t already have one. Common stock usually comes with voting rights, while preferred stock doesn’t.

Topics for Dissertation in Accounting And Finance by Experts

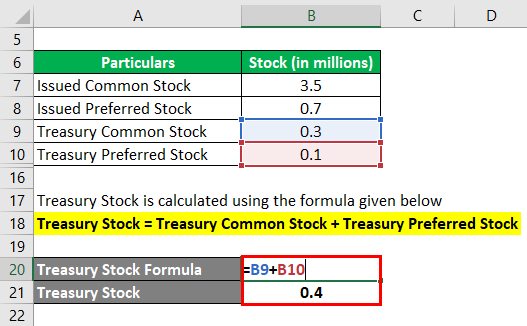

The outstanding stock is equal to the issued stock minus the treasury stock. Retained earnings are a company’s net income from operations and other business activities retained by the company as additional equity capital. They represent returns on total stockholders’ equity reinvested back into the company.

Related investing topics

Another reason for calculating common stock on the balance sheet is to help investors make informed investment decisions. Investors use the balance sheet to evaluate a company’s financial health and potential for growth. The calculation of common stock provides additional information about the company’s capital structure and how much money has been invested by shareholders.

Steps Involved in Calculating Common Stock on Balance Sheet

However, common stockholders have a lower position than preferred stockholders, who get priority on dividend payments and in recovering their investment if the company is liquidated. One of the primary reasons for calculating common stock on the balance sheet is to provide financial transparency. The balance sheet shows the company’s assets, liabilities, and equity, which helps stakeholders understand the company’s financial position. The calculation of common stock provides additional information about the company’s ownership structure and how many shares of stock are outstanding. The financial report of a company gives you the scoop on how it’s doing, including the value of the stock per share. It shows how much money was raised from selling shares to investors, often referred to as the common stock balance.

Accounting For Stockholders’ Equity

Common stock is different from preferred stock because the former type of stock allows voting rights to the holder. Ultimately, most positions in the investing industry will likely interact with common stocks one way or another. Common and preferred stock both let investors own a stake in a business, but there are key differences that investors need to understand.

- However, with any financial metric, it’s important to see how a company compares to its peers.

- It is the lifeblood of a company’s equity, offering insight into the value and health of an organization.

- Dividend yield expresses the annual return an investor can expect from dividends in relation to the stock’s current price.

- Otherwise, an alternative approach to calculating shareholders’ equity is to add up the following line items, which we’ll explain in more detail soon.

- Part of the ROE ratio is the stockholders’ equity, which is the total amount of a company’s total assets and liabilities that appear on its balance sheet.

- The certificate would indicate the type of stock (common, preferred), any restrictions pertaining to the sale of the stock, the number of shares, the par value, etc.

Thanks to the SEC, common stock outstanding is straightforward to calculate

For example, if a company has a total par value of $1,000 and additional paid-in capital of $119,000, the total amount of capital received from issuing shares of common stock would be $120,000. Another important distinction between the two types of stock relates to what happens when a company is liquidated. In the investor hierarchy, preferred stockholders are paid out first before common stockholders when a company goes bust. Preferred stock is another form of stock issued by companies or entrepreneurs sourcing capital from markets.

Common stocks are represented in the stockholder equity section on a balance sheet. Now before knowing further about common stocks, have a look at a balance sheet. For investors, dividends payable provide a clearer picture of the company’s current obligations.

Now that we’ve gone over the most frequent line items in the shareholders’ equity section on a balance sheet, we’ll create an example forecast model. From the viewpoint of shareholders, treasury stock is a discretionary decision made by management to indirectly compensate equity holders. The “Treasury Stock” line item refers to shares previously issued by the company that were later repurchased in the open market or directly from shareholders.

While not directly influencing common stock calculation, dividends can impact investor decisions. The dividend payout ratio shows how much of a company’s earnings are distributed to shareholders in the form of dividends. It reflects the balance between rewarding cash flow frog shareholders and reinvesting profits into the business for future growth. It’s also important to mention that some, but not all, cumulative preferred stocks have additional provisions to compensate shareholders if preferred dividends are suspended.

They also get dividends when issued by the company but do not have a preference to get it. The primary distinction between preferred and common stock is that common stock grants stockholders voting rights, while preferred stock does not. As a result, preferred shareholders get dividend payments before regular shareholders since they have a preference over the company’s income. The issuance of common stock cannot be more than the authorized number but can give less than the number of authorized shares. For example, the company issued 2000 shares during a public offering. So, in this case, the number of shares issued is equal to the company’s outstanding shares.

Shares bought back by companies become treasury shares, and their dollar value is noted in the treasury stock contra account. The shareholders equity ratio measures the proportion of a company’s total equity to its total assets on its balance sheet. Issuing common stock is recorded as a credit to the common stock account and a corresponding debit to the cash or other asset account received in exchange for the shares.